Table of Contents

- AVGO Stock Forecast & Price Prediction - What's Next for Broadcom Stock ...

- Buy Broadcom While You Can (NASDAQ:AVGO) | Seeking Alpha

- Broadcom Ltd: Bank on Upside in a Fresh AVGO | InvestorPlace

- AVGO Stock Price Quote & News - Broadcom | Robinhood

- AVGO Stock Price and Chart — NASDAQ:AVGO — TradingView

- AVGO Stock Another Price Target Hit - Hubert Senters

- AVGO Stock Price and Chart — TradingView

- AVGO, VMW: 13 Things to Know as Broadcom Inks Billion Deal With ...

- Will The AVGO Stock Price Rebound After A Recent Drop?: Guest Post by ...

- AVGO Stock Takes Aim At 300 Level As Earnings Approach | Investor's ...

Broadcom Inc. (AVGO) is a leading American semiconductor and software company that has been making waves in the technology industry. As a prominent player in the sector, the company's stock price and market performance are closely watched by investors and analysts alike. In this article, we will delve into the latest news, analysis, and trends surrounding Broadcom's stock price, providing you with a comprehensive overview of the company's current standing in the market.

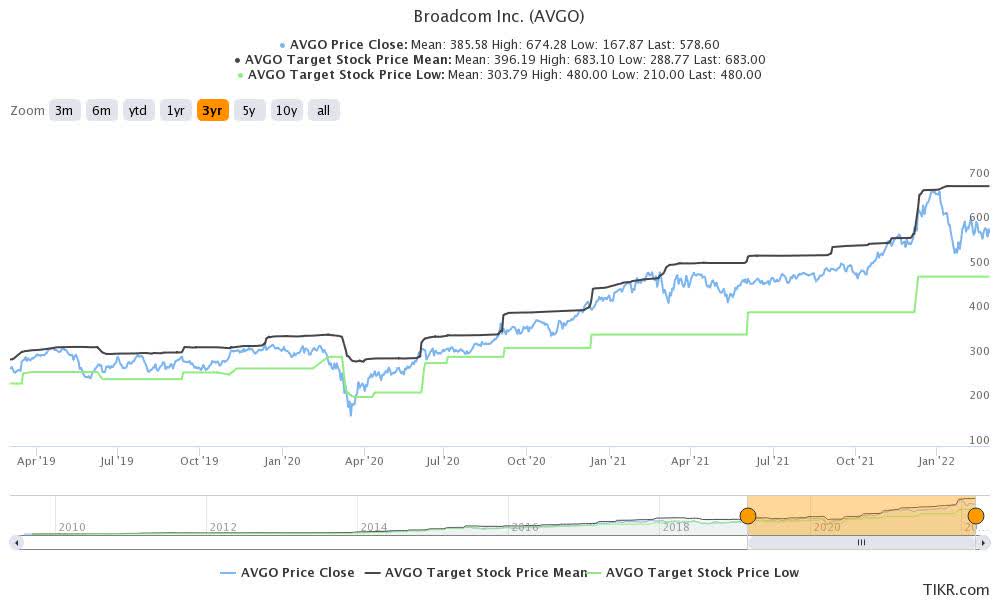

Current Stock Price and Performance

As of the latest market update, Broadcom's stock price is trading at around $450 per share, with a market capitalization of over $180 billion. The company's stock has been experiencing a steady upward trend, with a 12-month return of over 20%. This impressive performance can be attributed to the company's strong financials, innovative product offerings, and strategic acquisitions.

Recent News and Developments

Broadcom has been in the news recently due to its acquisition of Symantec's enterprise security business, which is expected to strengthen the company's position in the cybersecurity market. Additionally, the company has announced plans to expand its 5G product portfolio, which is anticipated to drive growth in the coming years. These developments have contributed to the company's positive stock performance and have investors optimistic about its future prospects.

Analyst Ratings and Recommendations

According to MarketBeat, a leading provider of stock market data and analysis, Broadcom's stock has received a consensus rating of "Buy" from top analysts. The average price target for the stock is around $500, indicating a potential upside of over 10% from its current price. This positive sentiment from analysts is a testament to the company's strong fundamentals and growth potential.

Market Trends and Outlook

The semiconductor industry is expected to experience significant growth in the coming years, driven by increasing demand for 5G technology, artificial intelligence, and the Internet of Things (IoT). Broadcom is well-positioned to capitalize on these trends, with a diverse product portfolio and a strong presence in the market. As the company continues to innovate and expand its offerings, investors can expect its stock price to reflect its growing prospects.

Risk Factors and Challenges

While Broadcom's stock has been performing well, there are potential risks and challenges that investors should be aware of. The company faces intense competition in the semiconductor market, and any disruptions to global supply chains or trade tensions could impact its operations. Additionally, the company's reliance on a few large customers may pose a risk to its revenue streams.

In conclusion, Broadcom's stock price and market performance are closely tied to the company's strong financials, innovative product offerings, and strategic acquisitions. As the company continues to navigate the evolving technology landscape, investors can expect its stock to remain a top performer in the market. With a strong outlook and positive analyst sentiment, Broadcom's stock is definitely worth considering for those looking to invest in the semiconductor sector.

Disclaimer: This article is for informational purposes only and should not be considered as investment advice. Investors should conduct their own research and consult with financial advisors before making any investment decisions.