Table of Contents

- The Whitlock Co. | Long-Term Care Expenses: What Can You Deduct?

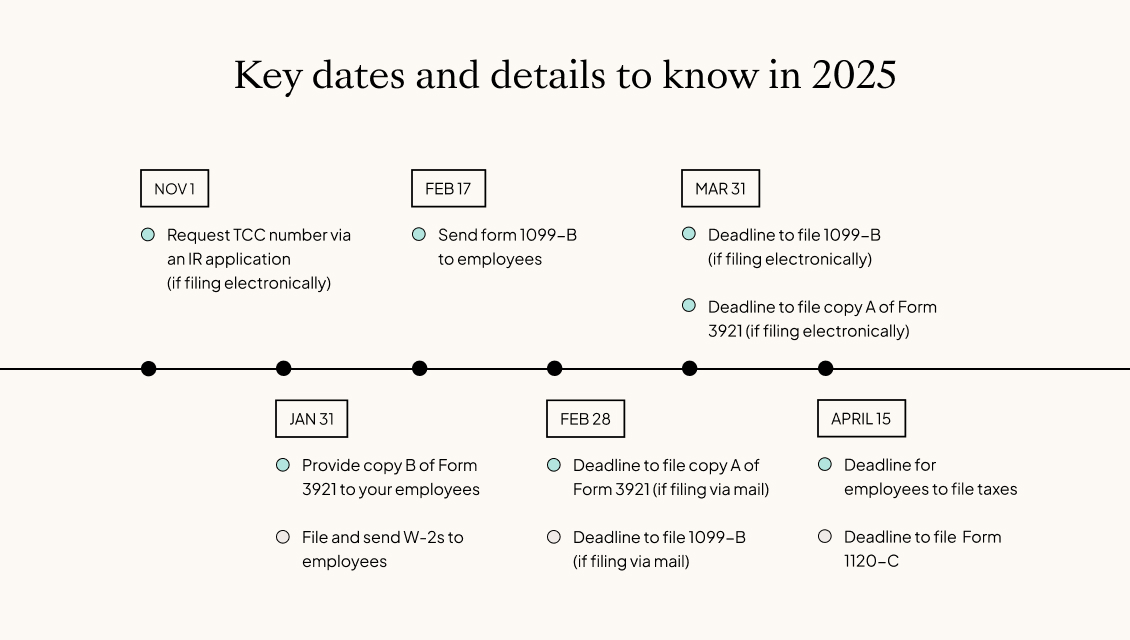

- Business Tax Deadlines 2025: Corporations and LLCs

- Tax Day 2024 Deadline: When is the Last Day to File Your Taxes ...

- 2025 Tax Deadline Calendar - Aya dekooij

- Tax Day 2024 Deadline: When is the Last Day to File Your Taxes ...

- Tax Payment Deadline 2025 - Ardene Carlynn

- 2025 Tax Filing Deadline California - Taylor Casey

- Income Tax Filing Date 2025 - Bette Sybilla

- Income Tax Filing Date 2025 - Bette Sybilla

- Tax Payment Deadline 2025 - Ardene Carlynn

The Internal Revenue Service (IRS) requires taxpayers to make estimated tax payments each quarter to avoid penalties and interest on their tax liability. The due dates for these payments are:

- April 15th for the first quarter (January 1 - March 31)

- June 15th for the second quarter (April 1 - May 31)

- September 15th for the third quarter (June 1 - August 31)

- January 15th of the following year for the fourth quarter (September 1 - December 31)

It's essential to make timely estimated tax payments to avoid penalties and interest. The IRS charges a penalty for underpayment of estimated taxes, which can add up quickly. Additionally, interest accrues on the unpaid amount, starting from the original due date of the payment.

Who Needs to Make Estimated Tax Payments?

Not everyone is required to make estimated tax payments. Generally, you need to make estimated tax payments if you expect to owe $1,000 or more in taxes for the year and you receive income that is not subject to withholding, such as:

- Self-employment income

- Interest, dividends, and capital gains

- Rent and royalty income

- Income from a business or partnership

How to Make Estimated Tax Payments

Making estimated tax payments is relatively straightforward. You can use one of the following methods:

- Electronic Federal Tax Payment System (EFTPS): This is a free service provided by the IRS that allows you to make online payments.

- Form 1040-ES: You can download and complete this form, then mail it to the IRS with a check or money order.

- Annualized Estimated Tax Method: This method allows you to make one payment for the entire year, rather than quarterly payments.

It's crucial to keep accurate records of your estimated tax payments, including the date and amount of each payment. You'll need this information when you file your tax return.

The first quarter estimated tax payment deadline is April 15th, and it's essential to make timely payments to avoid penalties and interest. If you're required to make estimated tax payments, don't miss this deadline. Use one of the approved methods to make your payment, and keep accurate records to ensure a smooth tax filing process. Remember, the IRS offers resources and guidance to help you navigate the estimated tax payment process. Take advantage of these resources to ensure you're meeting your tax obligations and avoiding unnecessary penalties.

By staying on top of your estimated tax payments, you can avoid costly penalties and interest, and ensure a stress-free tax season. Mark your calendar for April 15th and make your first quarter estimated tax payment on time.