Table of Contents

- Target Stock Is Falling Again

- What Is Target In Stock Market? Importance, Factors & More!

- Target Revenue a Bit Off Analysts' Target - Here's How to Trade the ...

- Target Stock (NYSE:TGT): Challenges Lie Ahead. Here’s Why - TipRanks.com

- Target Puts The Bullseye On Wal-Mart - Target Corporation (NYSE:TGT ...

- Target Joins The Retailers Integrating Apple Pay

- Target Stock Gaps Higher on Earnings Beat

- Target — Stock Photo © grublee #1045451

- Target | Stock image | Colourbox

- Business target marketing concept , 3d business graph with red rising ...

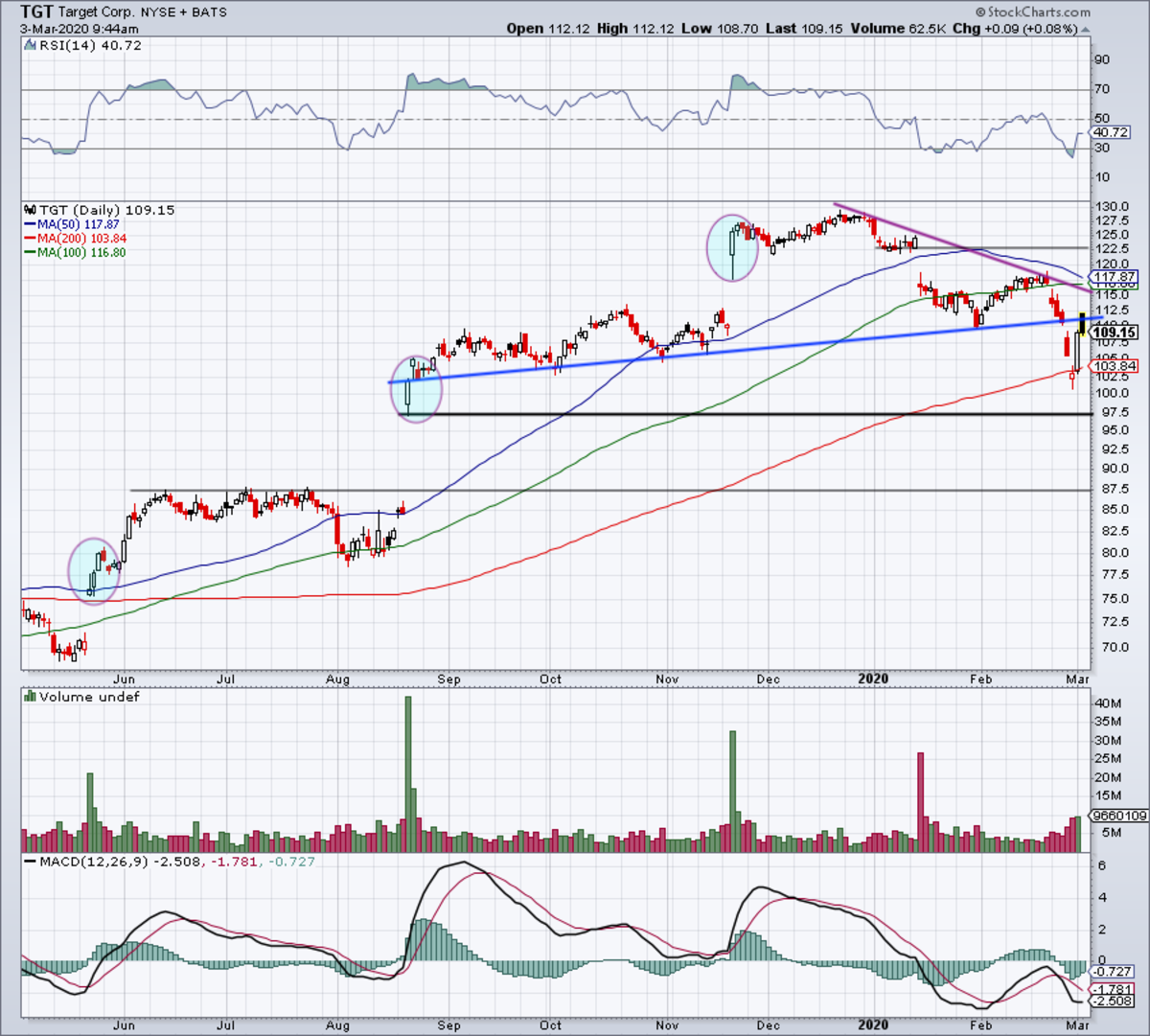

What's Behind Target's Decline?

Is it Time to Buy TGT Stock?

Should You Sell TGT Stock?

On the other hand, there are valid reasons to consider selling TGT stock. The retail landscape is rapidly changing, and Target's ability to adapt to these changes is uncertain. The company's debt levels are also a concern, with a total debt of over $15 billion. This could limit Target's flexibility to invest in its business and respond to changing market conditions. Moreover, the competitive pressure from online retailers and discount stores is unlikely to ease, which could continue to pressure Target's sales and profit margins. If the company fails to execute its strategy and improve its online presence, its stock price may continue to decline. Target's 52-week low has created a buying opportunity for investors who believe in the company's long-term potential. While there are risks associated with the stock, the company's efforts to enhance its omnichannel capabilities, strong brand portfolio, and attractive dividend yield make it an interesting option for investors. However, for those who are risk-averse or have concerns about the retail industry, it may be wise to sell TGT stock and wait for a clearer outlook. Ultimately, the decision to buy or sell TGT stock depends on your individual investment goals and risk tolerance. It's essential to conduct thorough research, consider multiple perspectives, and consult with a financial advisor before making any investment decisions.Disclaimer: This article is for informational purposes only and should not be considered as investment advice. Investing in the stock market involves risks, and it's essential to do your own research and consult with a financial advisor before making any investment decisions.