Table of Contents

- TSMC drives Taiwan stock exchange with 30% annual gain

- TSMC stock falls on reports of client order cuts - Taipei Times

- TSMC keeps rocking. 4nm process to be ready a quarter earlier ...

- ارزش سهام TSMC با رونق هوش مصنوعی، به بالاترین سطح تاریخ خود رسید

- TSMC: Secular Trends And Market Potential Make It A Strong Buy Ahead Of ...

- TSMC omits customer data in answers to US chip shortage inquiry ...

- TSMC cuts off client after discovering chips diverted to Huawei

- Is TSMC a good investment during this stock price jump? - The Grey Rhino

- Menemukan 50 Perusahaan dengan Kapitalisasi Terbesar di APAC

- TSMC: AI Chip Stock Surge and the Potential for a Stock Split

Taiwan Semiconductor Manufacturing Company Ltd. (TSM) is one of the world's leading independent semiconductor foundries, and its stock price has been a subject of interest for investors and industry watchers alike. In this article, we will provide an in-depth analysis of TSM's stock price, including its current trends, historical performance, and future prospects.

Introduction to TSM

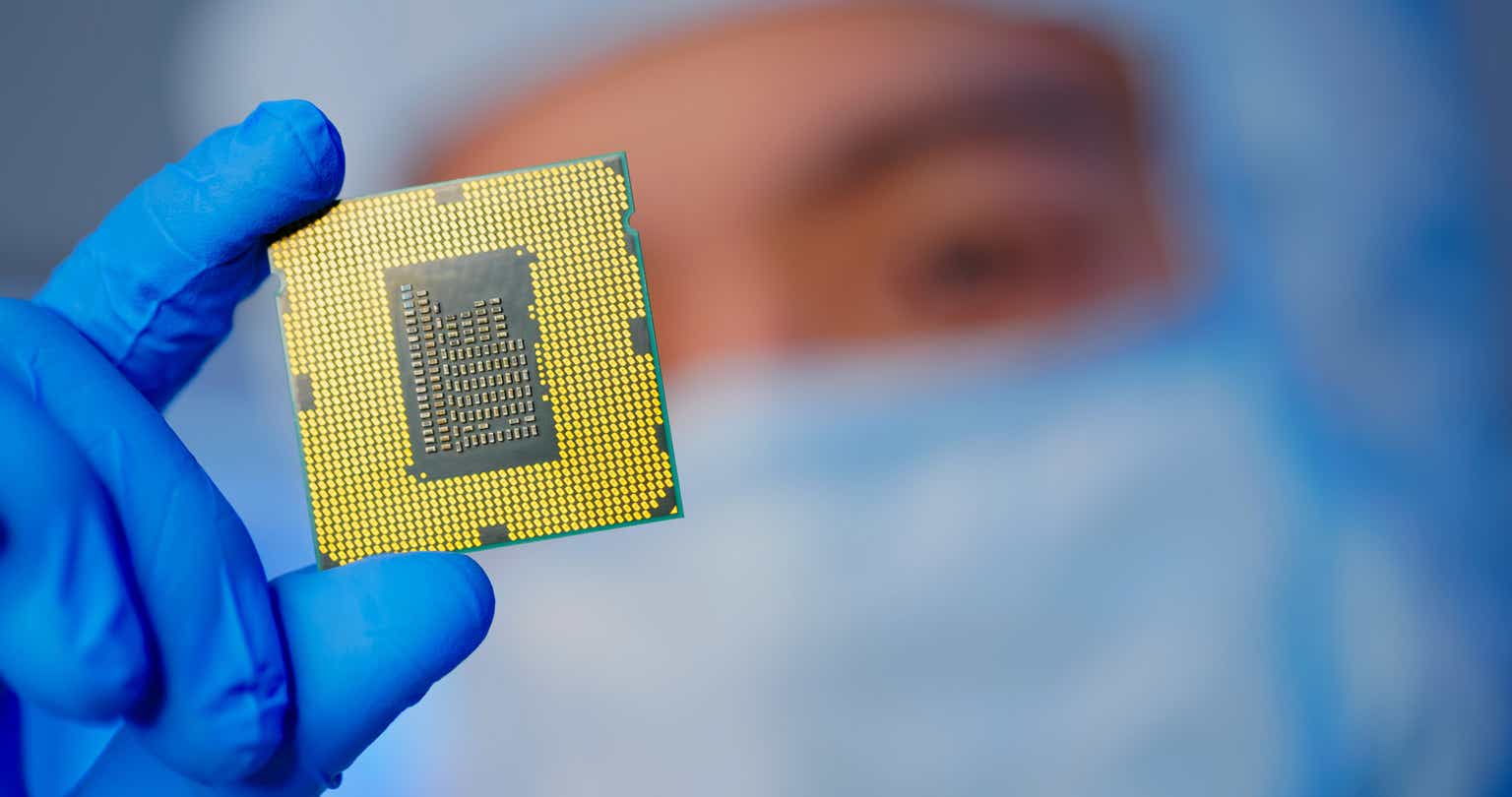

TSMC, also known as Taiwan Semiconductor Manufacturing Company Ltd., is a Taiwanese multinational company that specializes in the production of semiconductor chips. Founded in 1987, the company has grown to become one of the largest and most successful semiconductor foundries in the world. TSMC's clients include some of the biggest names in the tech industry, such as Apple, Qualcomm, and NVIDIA.

Current Stock Price Trends

As of the latest market data, TSM's stock price is trading at around $120 per share. The stock has experienced a significant surge in recent years, driven by the growing demand for semiconductor chips in various industries, including smartphones, laptops, and data centers. The company's strong financial performance, including a net income of $13.3 billion in 2022, has also contributed to the upward trend in its stock price.

Historical Performance

A review of TSM's historical stock price performance reveals a steady upward trend over the past decade. The stock has consistently outperformed the broader market, with a 10-year return of over 500%. The company's strong track record of innovation, coupled with its ability to adapt to changing market trends, has enabled it to maintain its competitive edge and drive growth.

Key Factors Influencing TSM Stock Price

Several factors have contributed to the fluctuations in TSM's stock price, including:

- Global Demand for Semiconductors: The increasing demand for semiconductor chips in various industries, including 5G, artificial intelligence, and the Internet of Things (IoT), has driven up the stock price.

- Competition from Rivals: The entry of new players in the semiconductor industry, such as Chinese companies, has increased competition and put pressure on TSM's stock price.

- Trade Tensions and Geopolitics: The ongoing trade tensions between the US and China have affected the global semiconductor supply chain, impacting TSM's stock price.

Future Prospects

Despite the challenges and uncertainties in the global semiconductor market, TSM's stock price is expected to continue its upward trend in the long term. The company's strong financials, innovative products, and strategic partnerships are expected to drive growth and increase its market share. Additionally, the growing demand for semiconductor chips in emerging technologies, such as autonomous vehicles and 5G networks, is expected to provide a boost to the stock price.

In conclusion, TSM's stock price has been a subject of interest for investors and industry watchers due to its strong historical performance and future growth prospects. While the company faces challenges and uncertainties in the global semiconductor market, its innovative products, strategic partnerships, and strong financials are expected to drive growth and increase its market share. As the demand for semiconductor chips continues to grow, TSM's stock price is likely to remain a key player in the tech industry.

If you're considering investing in TSM stock, it's essential to conduct thorough research and analysis of the company's financials, industry trends, and market conditions. With the right investment strategy, TSM's stock price could provide a lucrative opportunity for investors looking to capitalize on the growing demand for semiconductor chips.

Note: This article is for informational purposes only and should not be considered as investment advice. It's always recommended to consult with a financial advisor before making any investment decisions.