Table of Contents

- 2025 Irmaa Brackets Part B - Megan Butler

- Irmaa Brackets 2024- 2024 2025 - Gwenny Jenilee

- Irmaa Brackets For 2025 - Mirna Alejandrina

- The IRMAA Brackets for 2023 - Social Security Genius

- The IRMAA Brackets for 2023 - Social Security Genius

- Possible IRMAA 2025 Brackets

- The 2023 IRMAA Brackets - Social Security Intelligence

- Irmaa Brackets 2024- 2024 2025 - Gwenny Jenilee

- 2025 Irmaa Brackets Part B - Megan Butler

- Possible 2025 IRMAA Brackets

What are IRMAA Brackets?

2025 IRMAA Brackets

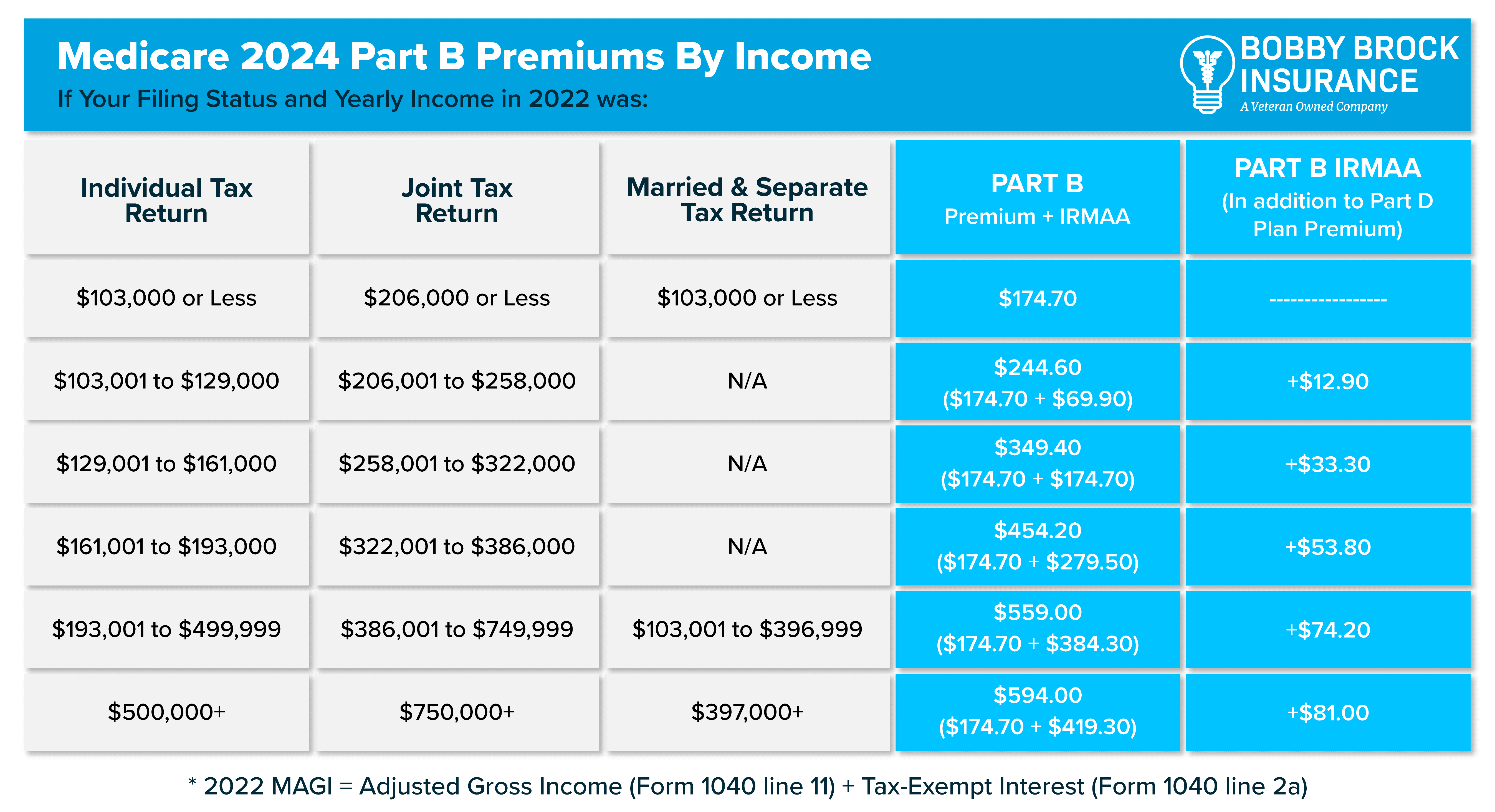

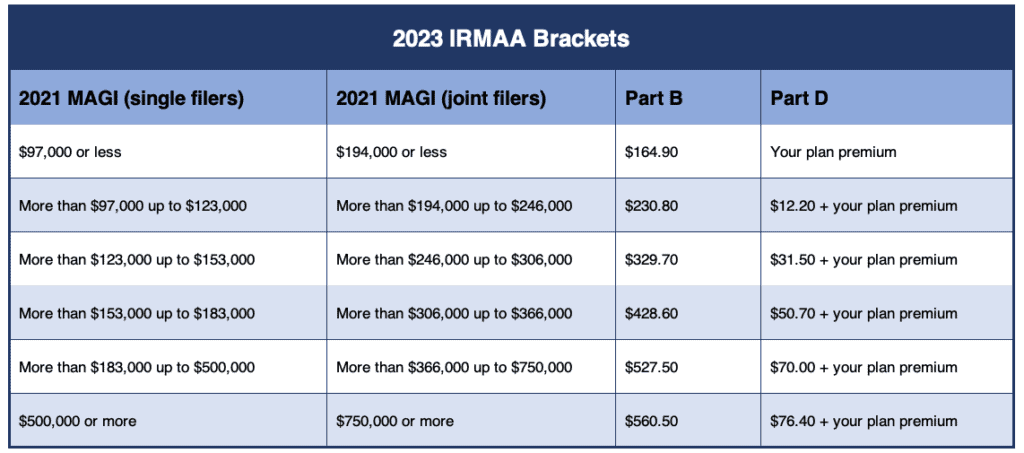

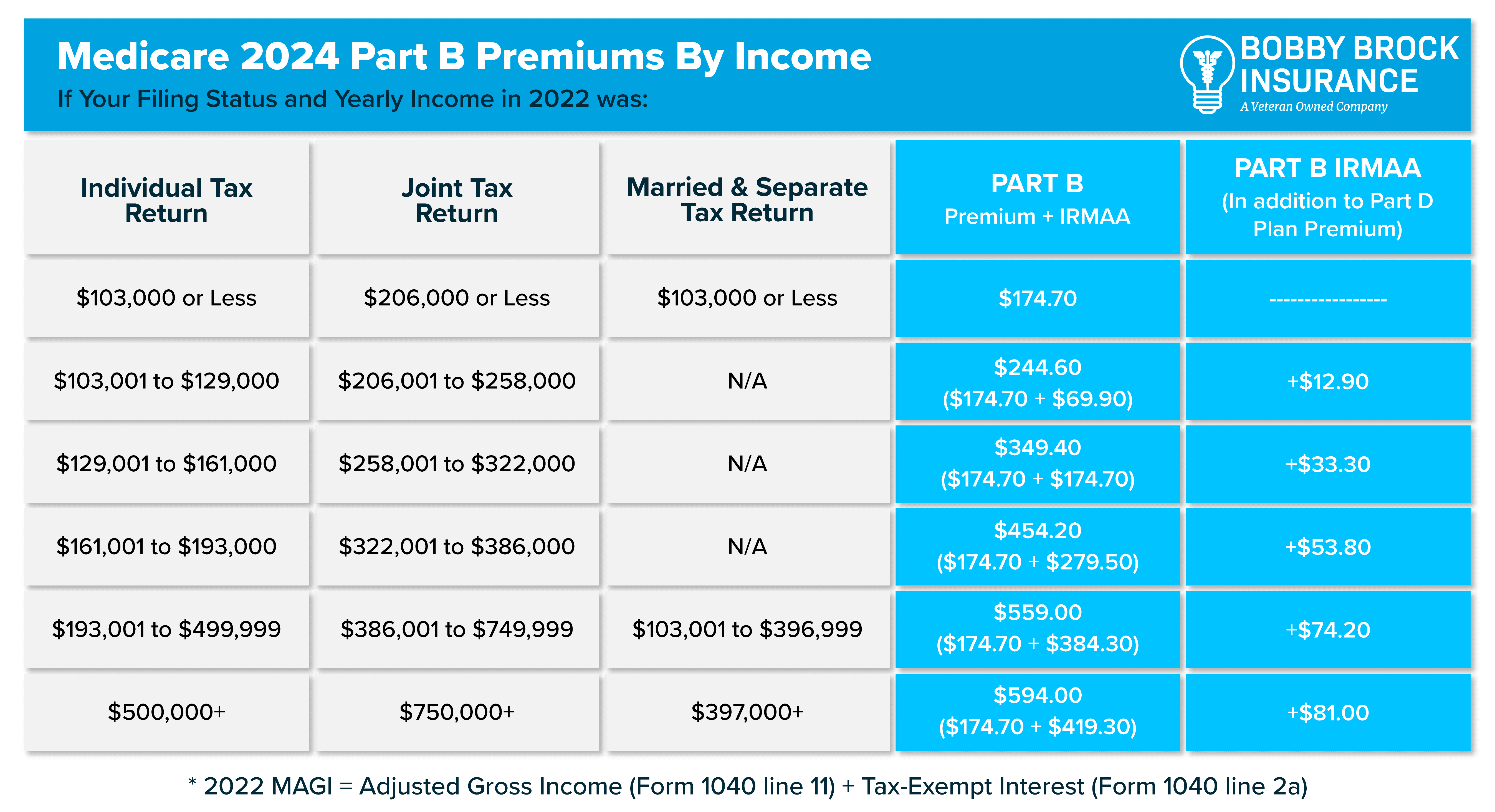

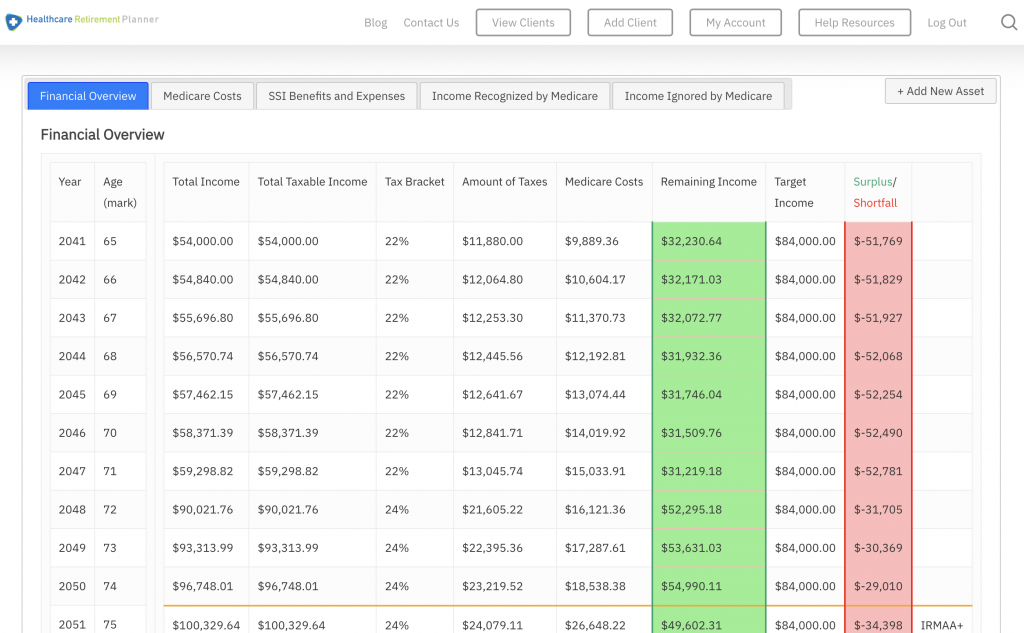

Medicare Part B and Part D Premium Surcharges

The premium surcharges for Medicare Part B and Part D are calculated based on the beneficiary's income and the IRMAA bracket they fall into. The surcharges are added to the standard premium rates for Medicare Part B and Part D. For example, if a single individual with an income of $150,000 falls into the third IRMAA bracket, they will pay a premium surcharge of $239.40 per month for Medicare Part B and $59.40 per month for Medicare Part D. Understanding the 2025 IRMAA brackets and their impact on Medicare Part B and Part D premium surcharges is crucial for Medicare beneficiaries. By knowing how the IRMAA brackets work and how they affect premium surcharges, beneficiaries can better plan for their healthcare costs and make informed decisions about their coverage. If you have any questions or concerns about the 2025 IRMAA brackets or Medicare premium surcharges, consult with a licensed insurance professional or contact Medicare directly.Keyword: 2025 IRMAA Brackets, Medicare Part B, Medicare Part D, Premium Surcharges

Meta Description: Learn about the 2025 IRMAA brackets and how they affect Medicare Part B and Part D premium surcharges. Understand the income-based thresholds and plan for your healthcare costs.