Table of Contents

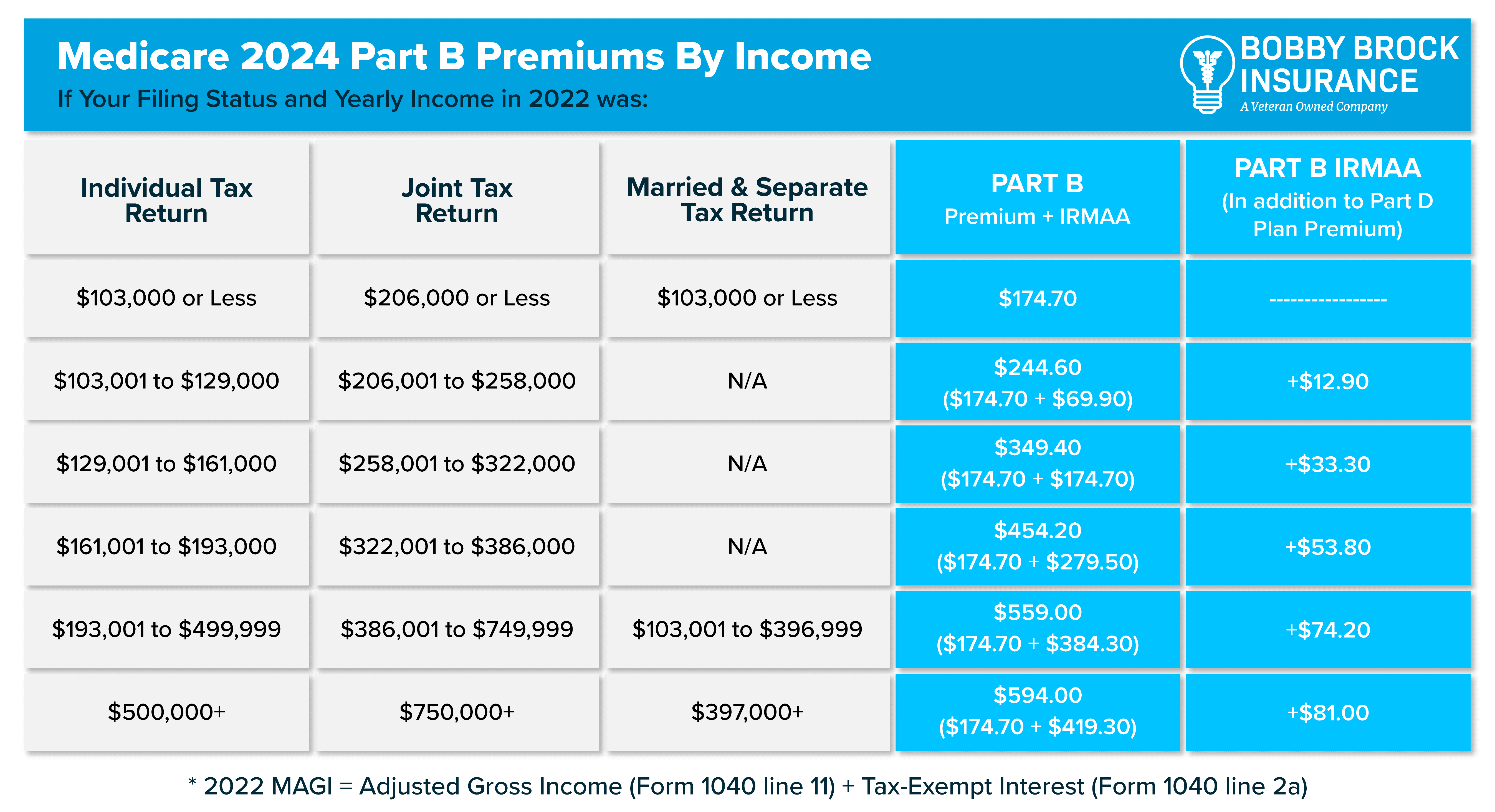

- 2025 Medicare Part B Irmaa Premium Brackets 2025 - Morteza Harrison

- Part B Medicare Premium 2025 - Jilli Gerianne

- Part B Medicare Premium 2025 - Jilli Gerianne

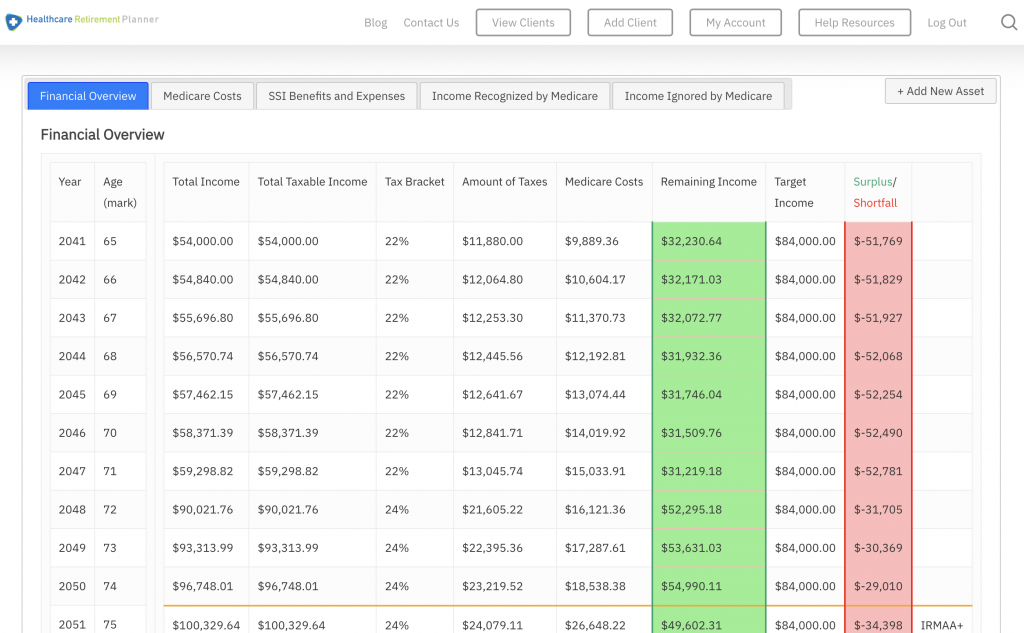

- [Just Released] Navigating Medicare IRMAA 2025 Brackets for Financial ...

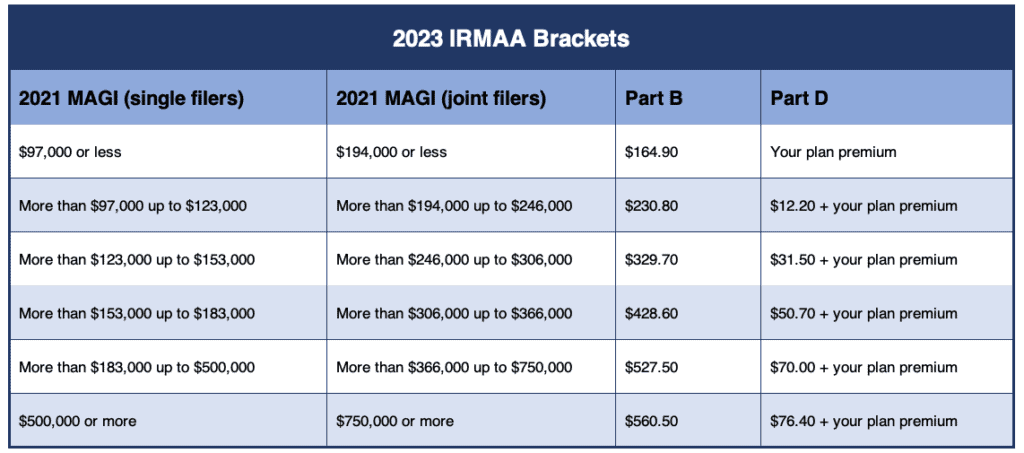

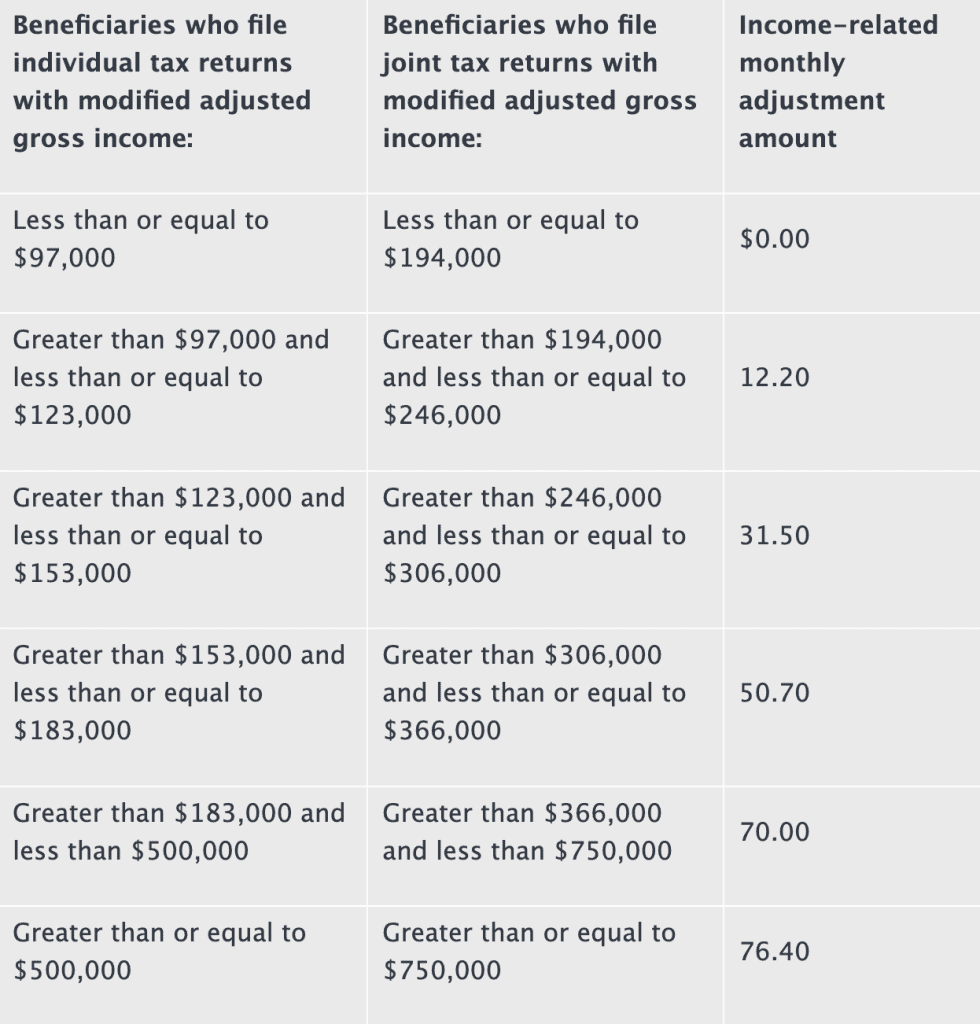

- The 2023 IRMAA Brackets - Social Security Intelligence

- 2025 Irmaa Brackets Part B - Megan Butler

- Irmaa 2025 Part D - Madge Ethelda

- Possible IRMAA 2025 Brackets

- Possible 2025 IRMAA Brackets

- 2023 IRMAA Brackets: What Are They + How to Avoid IRMAA | Permanent ...

![[Just Released] Navigating Medicare IRMAA 2025 Brackets for Financial ...](https://www.irmaacertifiedplanner.com/wp-content/uploads/2023/09/Screenshot-2023-07-24-at-7.55.27-AM-1536x875.png)

What are IRMAA Brackets?

2025 IRMAA Brackets

How to Minimize Your IRMAA Bracket

While you can't change your income, there are some strategies to minimize your IRMAA bracket: Consider Roth IRA conversions: Converting your traditional IRA to a Roth IRA can reduce your taxable income, potentially lowering your IRMAA bracket. Donate to charity: Donating to charity can reduce your taxable income, which may help you avoid a higher IRMAA bracket. Consult a financial advisor: A financial advisor can help you develop a strategy to minimize your IRMAA bracket and optimize your Medicare premiums. Understanding the 2025 IRMAA brackets is crucial to navigating the complex world of Medicare premiums. By staying informed and exploring strategies to minimize your IRMAA bracket, you can save money on your Medicare premiums and ensure you're getting the most out of your benefits. As a Social Security Pro, we're committed to providing you with the latest information and expert guidance to help you make informed decisions about your Medicare coverage.Disclaimer: The information provided in this article is for general purposes only and should not be considered as professional advice. It's essential to consult with a financial advisor or a Medicare expert to determine the best course of action for your specific situation.